29 Carbon Pricing

US decarbonization policy favors an approach to decarbonization that focuses not on global carbon pricing, but on driving innovation through national and transnational industrial networks. Tooze

29.1 CBAM

While some countries are moving ahead aggressively, ambition varies country-by-country such that four-fifths of global emissions remain unpriced and the global average emissions price is only $3 per ton. As a knock-on effect, some countries and regions with high or rising carbon prices are considering placing charges on the carbon content of imports from places without similar schemes. From a global climate perspective, however, such border carbon adjustments are insufficient instruments as carbon embodied in trade flows is typically less than 10 percent of countries’ total emissions.

29.2 Policy Sequencing

Meckling

Many economists have long held that carbon pricing—either through a carbon tax or cap-and-trade—is the most cost-effective way to decarbonize energy systems, along with subsidies for basic research and development. Meanwhile, green innovation and industrial policies aimed at fostering low-carbon energy technologies have proliferated widely. Most of these predate direct carbon pricing. Low-carbon leaders such as California and the European Union (EU) have followed a distinct policy sequence that helps overcome some of the political challenges facing low-carbon policy by building economic interest groups in support of decarbonization and reducing the cost of technologies required for emissions reductions. However, while politically effective, this policy pathway faces significant challenges to environmental and cost effectiveness, including excess rent capture and lock-in. Here we discuss options for addressing these challenges under political constraints. As countries move toward deeper emissions cuts, combining and sequencing policies will prove critical to avoid environmental, economic, and political dead-ends in decarbonizing energy systems.

The EU offers a prime example of this policy sequence. The EU adopted rules on promoting renewable energies in 2001, after eight member states had already implemented renewable-energy sup-port schemes. This occurred in the context of the liberalization of electricity markets across Europe. The EU followed up with indus-trial policy for renewable fuels in the transport sector in 2003.In a second phase, the EU adopted carbon pricing in 2003, which entered into force in 2005.In a third phase, the EU’s decarbonization efforts led to a ratcheting up of all measures in the 2020 Climate and Energy Package of 2009, the 2030 Climate and Energy Package of 2014, and the recent EU winter package of 2016. California followed a path similar to that of the EU11. China is on its way to replicate the policy path of climate leaders: in the mid-2000s, it adopted supply-side industrial policy to develop clean-energy industries, followed by feed-in tariffs that fostered domestic demand for renewable energy, leading to a domestic carbon pricing system in the energy sector to be implemented in 2017

Careful policy sequencing can help facilitate the progressive decarbonization of energy systems under political constraints, as California and the EU demonstrate. An excessive focus on the need for efficient pricing alone often ignores these constraints. A better integration of economic and political perspectives should help point the way forward on low-carbon policymaking

29.3 Limited Impact on Emissions

Green -Abstract

Carbon pricing has been hailed as an essential component of any sensible climate policy. Internalize the externalities, the logic goes, and polluters will change their behavior. The theory is elegant, but has carbon pricing worked in practice? Despite a voluminous literature on the topic, there are surprisingly few works that conduct an ex-post analysis, examining how carbon pricing has actually performed. This paper provides a meta-review of ex-post quantitative evaluations of carbon pricing policies around the world since 1990. Four findings stand out. First, though carbon pricing has dominated many political discussions of climate change, only 37 studies assess the actual effects of the policy on emissions reductions, and the vast majority of these are focused on Europe. Second, the majority of studies suggest that the aggregate reductions from carbon pricing on emissions are limited – generally between 0% and 2% per year. However, there is considerable variation across sectors. Third, in general, carbon taxes perform better than emissions trading schemes (ETSs). Finally, studies of the EU-ETS, the oldest emissions trading scheme, indicate limited average annual reductions – ranging from 0% to 1.5% per annum. For comparison, the IPCC states that emissions must fall by 45% below 2010 levels by 2030 in order to limit warming to 1.5 degrees Celsius – the goal set by the Paris Agreement (IPCC 2018). Overall, the evidence indicates that carbon pricing has a limited impact on emissions.

“Green -Memo*

Carbon taxes place a surcharge on fuel or energy use. In emissions trading schemes, the government sets a ceiling or cap on the total amount of allowed emissions. Allowances are distributed to those firms regulated by the scheme, either free of charge or by auction. Each firm then has the right to emit up to its share of allowances. They may also trade allowances with each other to meet their individual emission allocations. Those who emit more than their allowance can purchase more; those that emit less can sell their excess supply, or bank it for future use. an Carbon taxes and ETSs differ in a number of respects. First, carbon taxes provide certainty of cost: the price is set by the government. Yet there is no limit on emissions, provided that regulated entities are willing and able to pay the tax. By contrast, ETSs provide certainty of quantity: the cap, set by the government, constitutes the upper limit on emissions. The cost will vary, depending on the scarcity (or oversupply) of allowances, and other design features. In practice, the distinction between the two policies is sometimes blurred (Hepburn, 2006). For example, an ETS might have a floor price; this guaranteed price makes it resemble a tax.

First, the mismatch between the incremental effects of carbon pricing and the demand for rapid decarbonization cannot be understated. The IPCC states that emissions must fall by 45% below 2010 levels by 2030 in order to limit warming to 1.5 degrees Celsius – the goal set by the Paris Agreement (IPCC 2018). The Low Carbon Economy Index estimates that this translates to an annual emissions reduction of 11.3% by the “average” G20 nation (PwC 2019). Yet GHG emissions have risen an average of 1.5% per year in the last decade (UN Environment 2019, p. iv). It is important to understand the extent to which one of the most widely-used climate policies contributes to this goal.

Second, there is little evidence to suggest that carbon pricing promotes decarbonization The most common outcome is fuel-switching and efficiency improvements. Unlike policies which create pathways to decarbonization – such as binding renewable portfolio standards, feed in tariffs or investment in R&D – carbon pricing addresses emissions (flow), rather than overall concentrations of greenhouse gases (stock).

The real work of emission control is done through regulatory instruments. Within the EU, where nations are also part of the EU-ETS, nations without a carbon tax reduced emissions more quickly than those with a carbon tax.

It is astonishing how little hard evidence there is on the actual performance of carbon pricing policies using ex-post data. Tthe overall effect on reductions for both types of policy is quite small, generally between 0-2% per annum. Norway, Sweden and Denmark were early adopters, implementing some of the first carbon taxes in 1991-92. EU-ETS was the first compulsory emissions trading scheme, beginning in 2005.

The single study of California cap and trade scheme estimates that between 24%-43% of emissions from electricity generation were shifted out of state to avoid carbon pricing regulations.

The drivers of these modest reductions are incremental solutions: fuel switching, enhanced efficiency, and reduced consumption of fuels. These actions, though useful on the margins, fall well short of the societal transformations identified needed.

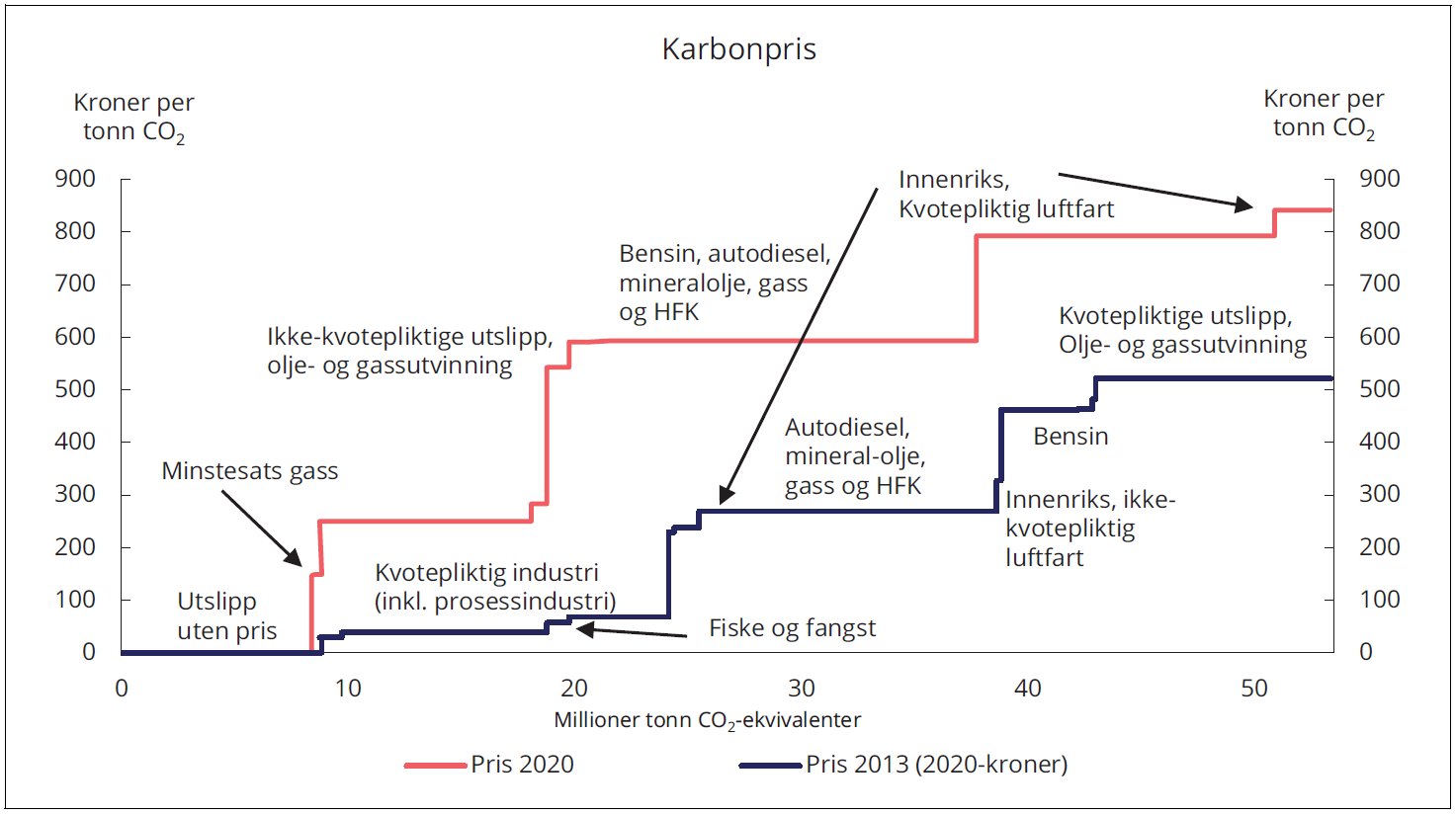

A common rejoinder is that carbon prices simply aren’t high enough to generate substantial emissions reductions. Indeed, low prices are pervasive; the vast majority of carbon prices are well below even the most conservative estimates of the “social cost of carbon” (SCC).

Given the prevalence of low prices, it is particularly important to consider the few jurisdictions with carbon prices at or near the SCC. Sweden has the highest carbon price in the world. Studies range in their reduction estimates from 0%-17% per year, with the upward bound being an outlier among all 37 studies. In 2019, Finnish taxes on transport fuels were at $68 per ton, and $58 per ton for all other fossil fuels. Emissions reductions there are estimated to be between 0%-1.7% The other two jurisdictions with high carbon taxes are Switzerland ($99 per ton in 2019) and Lichtenstein ($99 per ton in 2019 , No estimates of their effects on emissions).

It may be the case that pricing will work better after a certain threshold is surpassed. Indeed, Aydin and Esen find that energy taxes, including CO2 taxes, only reduce emissions after surpassing 2.2% of GDP (2018). Yet after nearly four decades of experience with carbon pricing, the empirical evidence to date suggests that low prices are a feature of this policy, rather than a bug. More worrisome is the fact that even those nations with high prices have relatively modest reductions.

A problem for carbon pricing concerns leakage, which occurs when economic activity subject to carbon pricing shifts to a jurisdiction without similar regulations. This problem is pervasive in environmental regulation, driven by variation in policy stringency. To the extent that leakage occurs, but is excluded from the studies examined here, emissions reductions may be overestimated.

Offsets can have two possible impacts on overall reductions. First, to the extent that offsets are not additional, their use will decrease the actual reductions achieved through a carbon pricing policy. To date, offsets have been an important component of most ETSs.