Market-Concentration-at-Top

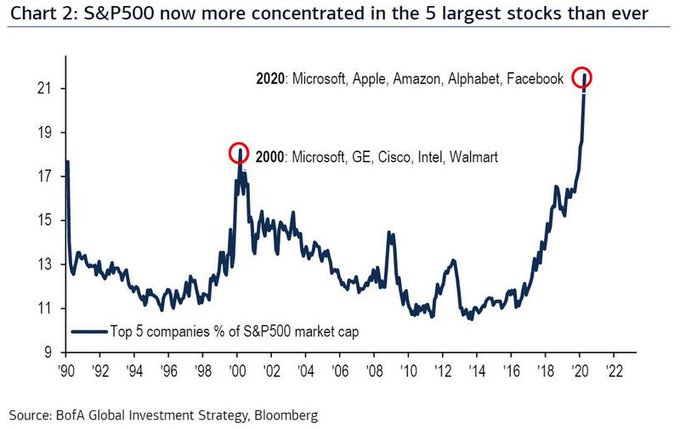

The tech mega-cap stocks (FAANGM) now represent 24% of the S&P 500 capitalization. Poor Fund Managers: if you manage billions you are forced to allocate it to assets that are both highly liquid and performing. This keeps pushing more money into fewer assets. Market concentration of this type is a sign of a top. Market strength is always distinguished by breadth. (Lance Roberts, Peter Schmidt).

FAANGM - Facebook, Amazon, Apple, Netflix, Google and Microsoft]