Decline of the Dollar

Fifty years ago the US was the world’s main creditor nation. Today it is the world’s main debtor nation.

Yanis Varoufakis explains the turnaround in his Global Minotaur book.

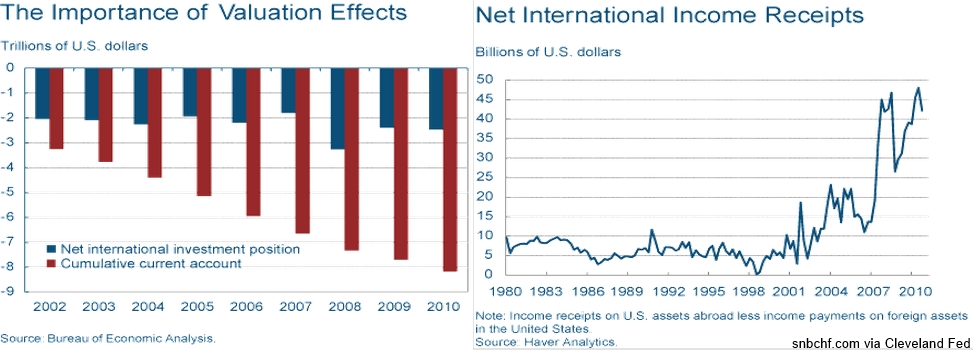

The Economist observes that the US is an unusual borrower with Net Debts, but Big Returns. Since 1989 foreigners have owned more assets in America than Americans have owned overseas, that is the Net International Investment Position - NIIP has been negative - and increasingly so, yet the Americans manage to increase their net international income receipts:

The clue seems to be the depriciation of the dollar - some 30% since 2002. Dollar depreciations increase the dollar value of US claims on foreigners (denominated in foreign currencies). A parallel is the increased value (in Norwegian Krone) of the Norwegian Sovereign Wealth Fund as the Krone depreciated due to falling oil prices.

A further clue is the compostion of the debt. Between 2000 and 2010, U.S. investments abroad had an increasing percentage of direct investments and securities, while claims on the U.S. rose particularly by foreign central banks (the dollar as a reserve currency). Since the former had a higher yield than the latter, the Americans managed to increase more and more the net income receipts.

So - the Minotaur is still alive, even after the 2008 financial crisis.

However, recents signs point to decreased role of the Dollar as the major reserve currency. Reform or Replacemnet of The Bretton Wood’s institutions are long overdue

So - May be the time finally has come for Ernest Mandel’s vision from the 1960’s - Decline of the Dollar

The parallel between the decline of the British Pound as reserve currency in the 1960’s and of the Dollar today is striking. As Mandel put it in 1968: The dollar’s function as a reserve currency corresponds to the balance-of-trade deficits which most capitalist countries have with the United States. …”The-Americans-who-are-buying-‘our’-factories-with-the-paper-dollars-they-are-sending-us” is a Gaullist myth. In reality the American monopolies are buying up the European factories with the capital which the European banks advance as loans. And these banks loan them this capital because the American monopolies are richer, more solid, make higher profits, and offer more security than the European monopolies. What must be challenged is the whole logic of the capitalist system, not Wall Street’s diabolical use of the dollar.