13 Fuel Cells

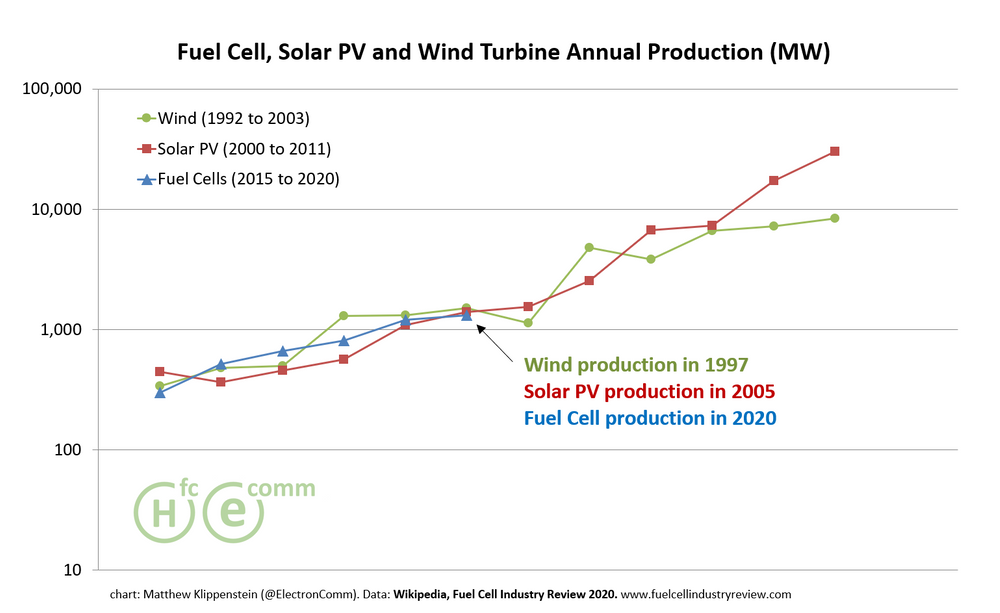

Fuel cells are scaling up exactly as solar and wind did in previous decades.

Fuel cells electrochemically convert hydrogen and oxygen into direct-current electricity.

Fuel cells employ an assortment of electrolytes, catalysts and temperatures. But in almost all cases, the membranes are expensive to fabricate, and the technologies require precious metal catalysts (typically platinum or palladium) or high process temperatures. Input fuels range from natural gas to methanol to hydrogen. Ongoing research and development efforts, some led by the DOE, are underway to reduce the need for expensive metals and to improve the reliability and lifetime of the fuel cell stack.

Common technologies include proton-exchange membrane (PEM), solid oxide (SOFC), phosphoric acid (PAFC) and molten carbonate (MCFC). There are a number of other technologies, all adept at destroying investor capital. GE, GM, Hyundai, Honda, Johnson Matthey, Panasonic, Siemens, Samsung, LG, Sharp, Toshiba and Toyota have all invested in (and in many cases ultimately abandoned) fuel cell technology.

Bloom Energy, Doosan and FuelCell Energy build large stationary fuel cells, using SOFC, PAFC and MCFC technologies, respectively. Plug Power, on the other hand, targets its PEM fuel cell system at powering forklifts and other vehicles in the enormous materials handling market.

While Bloom’s and FuelCell Energy’s equipment runs on natural gas, Plug Power’s PEM fuels cells run on pure “five nines” hydrogen and work most productively with a hydrogen infrastructure at the customer site.

The U.S. Department of Energy continues to fund fuel cell development, most recently with $33 million to support hydrogen and fuel cell research and development, infrastructure supply-chain development and validation, and cost analysis activities.