15 Profit-rate

Roberts

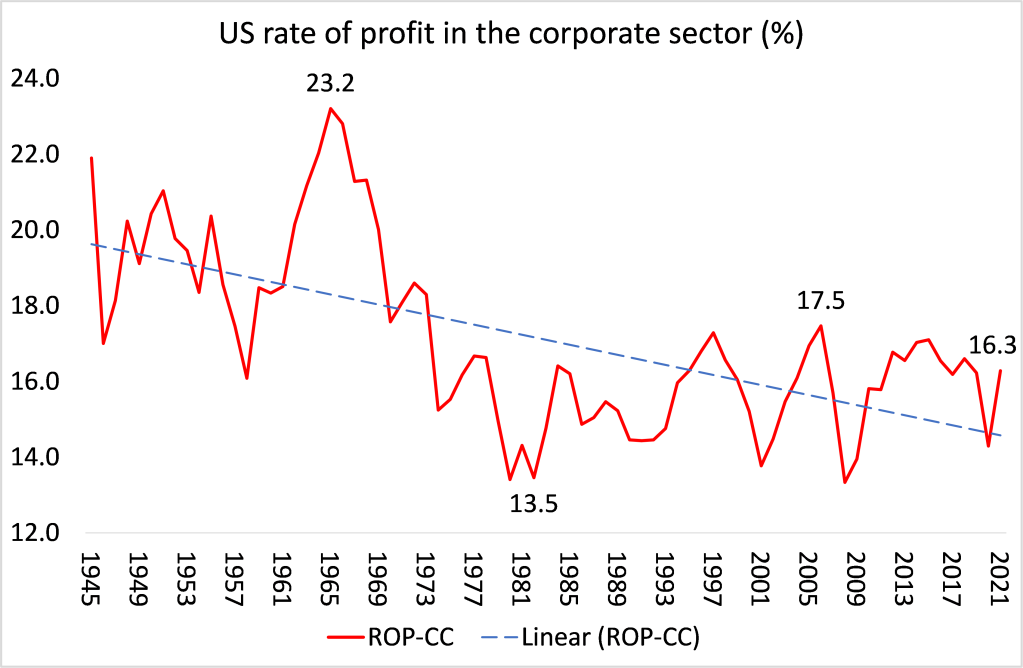

Marx’s law of the tendency of the rate of profit to fall is confirmed by the trend in the US rate of profit. This has fallen 27% over the period 1945-2021. We can also discern the huge fall in profitability from 1965-82 from 23.2% to 13.5%. And we can identify a recovery during the so-called neo-liberal period from 1982 to 17.5% in 2006. After that, the rate of profit falls gradually, but in a series of booms and slumps, in what I call the period of the Long Depression, to 16.3%.

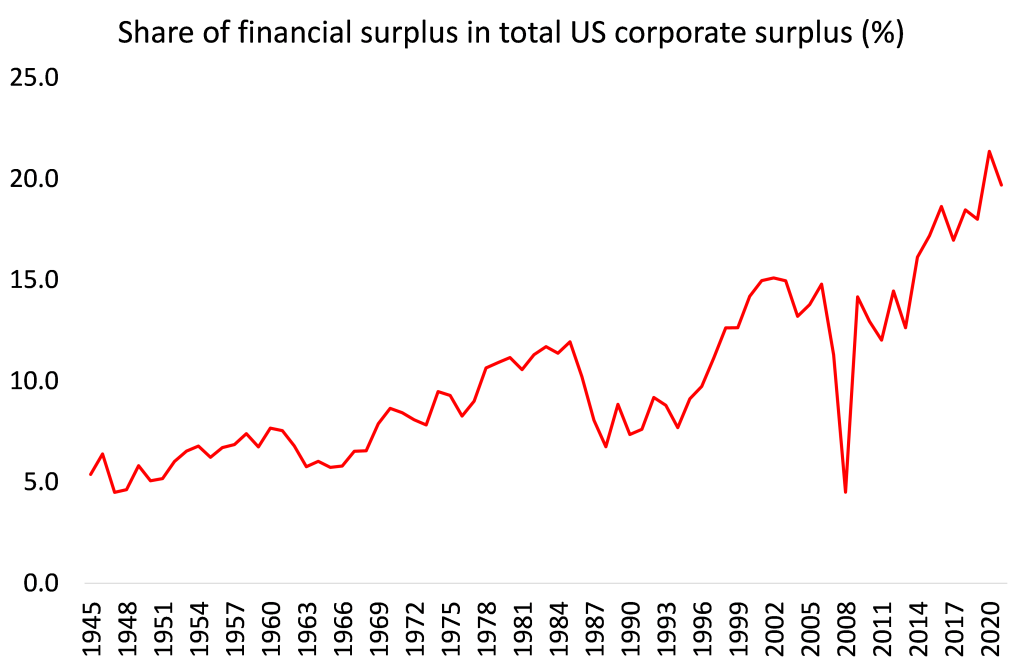

What you also notice from this measure is that the US corporate rate of profit rose from 1982 up to a peak in 2006. So it could be argued, as some have done, that Marx’s law cannot be the underlying cause of the Great Recession in 2008-9 if the US rate of profit was reaching a 25-year high in 2006. But if we look just at the non-financial corporate sector (NFC), a proxy for what we might call the ‘productive’ part of the capitalist economy (where workers create new value for capitalists), then it is a different story. In Marxian value theory, the financial sector does not create new value; it takes a cut from the profit extracted from labour in the non-financial (productive) sector. And it is the rise in financial sector profits particularly since 1997 that distorts the corporate rate of profit up to 2006.

So looking at NFC profit rate is more relevant to the underlying health of the US capitalist economy. When the rise in financial profits is taken out of the data, we find that non-financial sector profitability peaked much earlier than 2006; instead back in 1997.

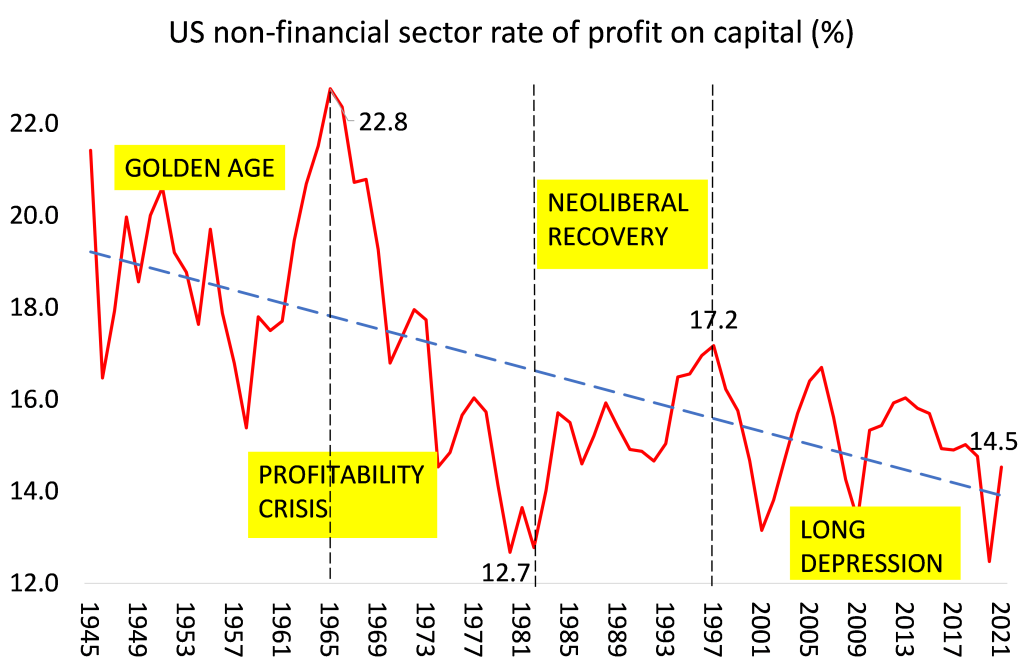

What the NFC graph also shows is that there has been a secular fall in the US rate of profit on non-financial capital over the last 75 years – a la Marx. Basu-Wasner calculate the average annual fall in the rate of profit at -0.42%. Between 1945 and 2021, the NFC rate of profit fell 32%.

In the so-called ‘golden age’ of post-war US capitalism, the NFC rate of profit was very high, averaging over 20%, rising 6% from 1945-1965. But then came the profitability crisis period between 1965 and 1982, when the rate of profit fell 44%. This provoked two major slumps in 1974-5 and 1980-2 and led to the strategists of capitalism trying to restore the rate of profit with the ‘neoliberal’ policies of privatisation, the crushing of unions, the deregulation of finance and globalisation from the early 1980s onwards.

The ‘neoliberal’ period of 1982-97 saw the rate of profit in the non-financial sector rise by 34%, although at the 1997 peak, the rate was still below the average in the Golden Age. Then came a new period of profitability crisis, which I have dubbed the Long Depression. In this period, which includes the Great Recession of 2008-9 and, of course, the COVID slump of 2020, the rate of profit fell 15%. In 2020, the US rate of profit in its non-financial sector reached a 75-year low, but recovered in somewhat 2021, but still below the pre-pandemic rate in 2019.

In the profitability crisis of 1965-82, the NFC rate of profit fell 44% as the organic composition of capital (OCC) rose 29% and the rate of surplus value (ROSV) fell 28%. Conversely, in the so-called ‘neo-liberal’ period from 1982 to 1997, the rate of surplus value rose 14%, while the organic composition of capital fell 15%, so the rate of profit rose 34%. Since 1997, the US rate of profit has fallen around 15%, because the organic composition of capital has risen 28%, outstripping the rise in the rate of surplus value (8%). In other words, in the first two decades of the 21st century US non-financial sector capitalists exploited the workforce even more, but not enough to stop the rate of profit falling. So Marx’s law of profitability is confirmed by the results in each of these periods, as it is for the whole period of 1945-2021.

If profitability persistently falls, then eventually the mass of profits will start to fall and that is the trigger for a collapse in investment and a slump.