9 Venture Finance

Tooze

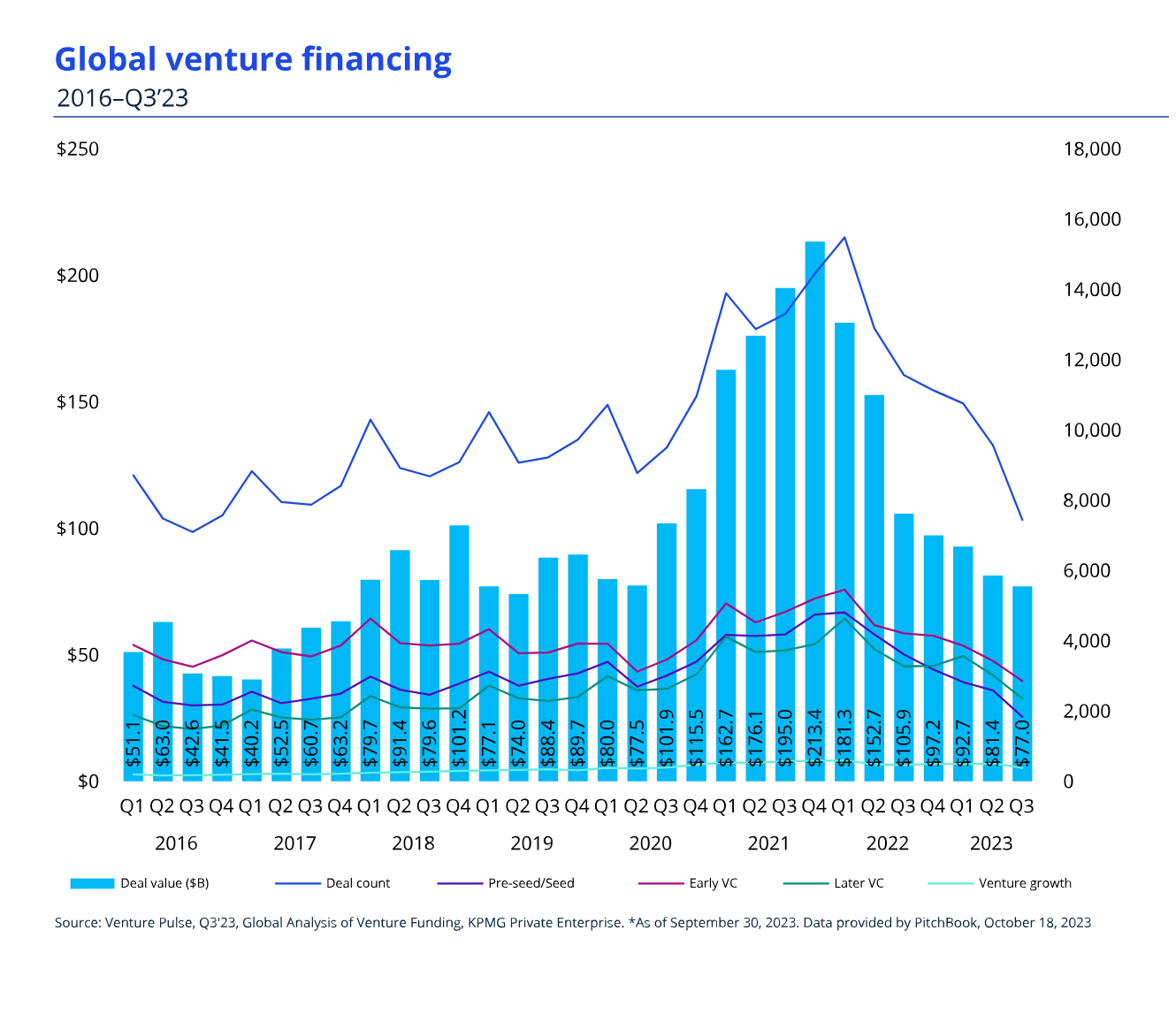

Capital is less and less flowing to startup innovation:

For the seventh quarter in a row, venture activity continued to subside in Q3 2023. Both venture financing volume and aggregate deal value worldwide hit tallies once again in line with the boom period observed in the early 2020s. All that said, it is important to note that subsiding from record tallies is to be expected in market cycles, especially given the array of shocks that economies and global financial systems have endured over the past three years and counting. In addition, there are signs of a moderation in the pace of slowing investment, i.e., a plateau may be in the offing. When additional data is collected, aggregate deal value could be closer to Q2’s tally than current figures suggest. Moreover, dealmakers seem to be further adapted to all the multiple volatile factors that have slowed the pace of investment thus far, while financing metrics are moderating to levels that may be more doable for many fund managers. It remains to be seen if a plateau does emerge, but there are at least some promising indicators.